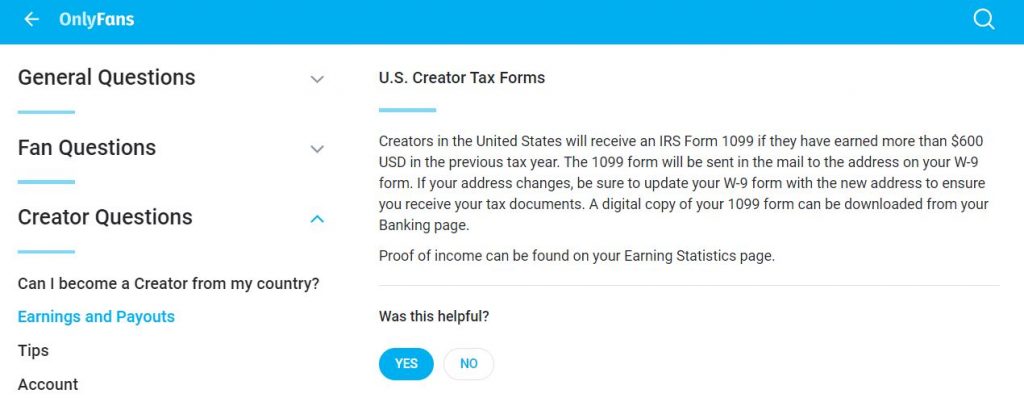

How to get onlyfans tax form - How to make an OnlyFans in 2021: Complete guide to get started

How to Complete a W‐9 Tax Form: 9 Steps (with Pictures)

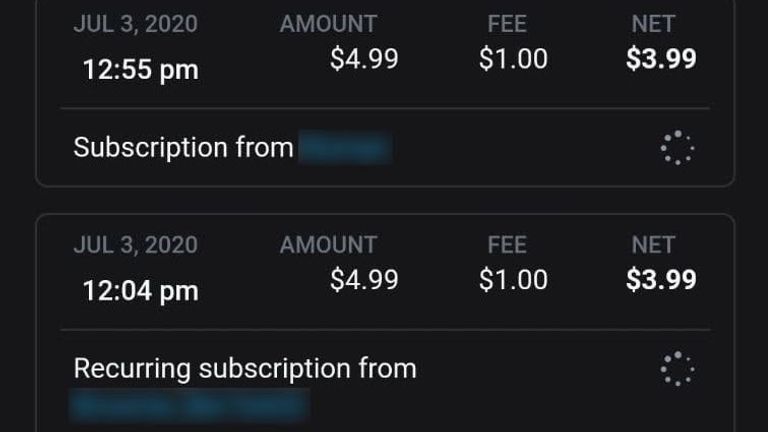

It is extremely important that you put aside money every time that you are paid so you can pay your estimated taxes later.

While a freelancer could qualify for certain deductions, it may not mean the same will apply to you.

Your employer sends you a W2 each January to report your wages and withholding.

How To Do Taxes For Onlyfans Canada

The W-9 form is also used in certain other less common circumstances, related to investment and debt-collection.

When you , attach each of the 1099 forms you have received.

For people who want some help staying organized, a is a great resource.

- Verwandter Artikel

2021 callawayapparel.sanei.net